These 2 articles are definitely worth your time. After you have read them, please, take some time to write/call/email any/all Senators and tell them "NO PUBLIC OPTION".

You can do a mass mailing at:

http://www.emailsenators.com/

Send emails to both Dems & Republicans (Olympia Snowe, R-Maine, is on the fence right now).

FIRST ARTICLE:

- The Foundry - http://blog.heritage.org -

Morning Bell: Government-Run Health Care by Next Thursday?

Posted By Conn Carroll On September 30, 2009 @ 8:58 am In Health Care | 40 Comments

The Washington Post front page blares today: “Prospects for Public Option Dim in Senate.” [1] Don’t believe it. Yes, the Senate Finance Committee did vote down two amendments that each would have added a government-run insurance plan to the committee’s health care bill. But two key Democrats who voted against Sen. Jay Rockefeller’s (D-WV) public plan, Bill Nelson (D-FL) and Tom Carper (D-DE), voted for Sen. Chuck Schumer’s (D-NY) version.

According to an independent analysis [2] of Senate Democrat public statements on the public option, that raises the number of Democrats on record supporting a public option from 47 to 49. Moreover, Sen. Tom Harkin (D-IA), chairmen of the Health, Education, Labor and Pensions (HELP) Committee, told the liberal “Bill Press Radio Show” yesterday that Democrats “comfortably” [3] have the remaining votes to reach 51 and pass a public plan once the debate moves to the House floor.

But what about Senate Finance Chairman Max Baucus’ (D-MT) claim yesterday that, “No one has been able to show me how we can count up to 60 votes with a public option.” That may be true, but it is also irrelevant. The question is not whether Democrats can muster 60 votes to pass Obamacare; they only need 51 votes to do that. The only time the number 60 will be relevant is when the Senate votes on whether to end debate and vote on the final bill. This is a separate question. We can see Senators from red states like Ben Nelson (D-NE), Blanch Lincoln (D-AR), and Kent Conrad (D-ND) voting against an amendment creating a public option. But voting with Republicans against their party and against their President to support a Republican filibuster? That would take a lot of courage. It would guarantee that these Democrats would face fierce opposition from their leftist bases back home. Just ask the left’s new whip for the public option, Michael Moore. Speaking to women’s groups and unions in Washington, DC, yesterday, Moore warned [4]:

To the Democrats in Congress who don’t quite get it: I want to offer a personal pledge. I – and a lot of other people – have every intention of removing you from Congress in the next election if you stand in the way of health care legislation that the people want. That is not a hollow or idle threat. We will come to your district and we will work against you, first in the primary and, if we have to, in the general election.

Moore is, of course, the perfect spokesman for the public option. He is in Washington promoting his new film “Capitalism: A Love Story” in which Moore argues that “Capitalism is an evil, and you can’t regulate evil.” [5] A more succinct summation of theory behind the public option does not exist. While supporters of the plan, including the White House, insist that the purpose of the public option is to bring “choice and competition” to the health care, nothing could be further from the truth. As Reps. Barney Frank (D-MA), Jan Schakowsky (D-IL), Anthony Weiner (D-NY) [6] Washington Post blogger Ezra Klein, and Noble Prize winning New York Times columnist Paul Krugman have all candidly admitted, the public option is nothing more than a Trojan horse for a single-payer, government-run health care system. [7] Moore even told Rolling Stone magazine [8] this summer:

If a true public option is enacted — and Obama knows this — it will eventually bring about a single payer system, because the profit-making insurance companies won’t be able to compete with a government run plan and make the profits they want to make.

So just how close are we to being inflicted with the Obama/Moore dream of anti-capitalist, competition-free, government-run health care? Closer than many realize. Multiple sources on the Hill have told The Foundry [9] that as early as next week, the Senate could be debating Obamacare. Senate Majority Leader Reid has stated an intention to take the HELP Committee product and merge it with the Senate Finance Committee markup that is expected to be over by this Thursday or Friday. Their plan [10] is to proceed to a House passed non-health care bill to provide a shell of legislation to give Obamacare a ride to the House and then straight to the President’s desk.

Quick Hits:

* According to a Government Accountability Office, state and federal officials failed to detect $65 million in Medicaid prescription drug fraud [11], including thousands of prescriptions written for dead patients or by people posing as doctors during 2006 and 2007.

* A historic bridge at Bill Clinton’s Presidential Library is slated to get $2.5 million [12] of federal stimulus money.

* The Center for American Progress, a liberal think tank with close ties to President Barack Obama [13], is releasing a report calling on Obama to further break his ‘no tax increase on middle-class families’ pledge.

* A former ACORN field director testified in court [14] yesterday about extra payments to Las Vegas canvassers for bringing in 21 new registration cards in a day.

* In 2008, the median household income in the United States plummeted 3.6% from the year before, and the percentage of people living in poverty soared to an 11-year high [15], according to U.S. Census data.

Article printed from The Foundry: http://blog.heritage.org

SECOND ARTICLE:

Congress’s Secret Plan to Pass Obamacare

by Brian Darling (more by this author)

Posted 09/29/2009 ET

Updated 09/29/2009 ET

President Obama and liberals in Congress seem intent on passing comprehensive health care reform, even though polls suggest it is unpopular with the American people. And despite the potential political risks to moderate Democrats, the President and left-wing leadership in Congress are determined to pass the measure using a rare parliamentary procedure.

The Senate plans to attach Obamacare to a House-passed non-healthcare bill. Ironically, nobody knows what that legislation looks like, because it has not yet been written. Yet many members plan to rubber-stamp Obamacare without reading or understanding the bill.

The Senate Finance Committee worked furiously last week to mark up a “conceptual framework” of health care reform. The committee actually rejected an amendment by Sen. Jim Bunning (R.-Ky.) to mandate that the bill text and a final cost analysis by the Congressional Budget Office (CBO) be publicly available at least 72 hours before the Finance Committee votes on final passage.

The following four-step scenario describes one way liberals plan to work the rules in their favor to get Obamacare through the Senate:

Step 1: The Senate Finance Committee must first approve the marked-up version of Sen. Max Baucus’ (D.-Mont.) conceptual framework. Then Senate Majority Leader Harry Reid (D.-Nev.) can say that two Senate Committees have passed a health care bill, which will allow him to take extraordinary steps to get the bill on the Senate floor.

During the mark-up last week, members had difficulty offering amendments and trying to make constructive changed because they lacked actual legislative text and Baucus made unilateral last minute changes. For example, the AP reported that “under pressure from fellow Democrats, the chairman of the Senate Finance Committee decided to commit an additional $50 billion over a decade toward making insurance more affordable for working-class families.”

Step 2: Sen. Reid will take the final product of the Senate Finance Committee and merge it with the product of the Senate Health, Education, Labor and Pensions (HELP) Committee, which passed on a party-line vote in July.

Usually, a bill is voted out of committee, and then the Senate takes up the final product of the committee so that all 100 senators can have a hand in the process. With some help from the Obama administration, Reid will decide what aspects of the HELP and Finance Committee bills to keep.

Step 3: Now, Obamacare will be ready to hitch a ride on an unrelated bill from the House. Sen. Reid will move to proceed to H.R. 1586, a bill to impose a tax on bonuses received by certain TARP recipients. This bill was passed by the House in the wake of the AIG bonus controversy and is currently sitting on the Senate Legislative Calendar.

The move to proceed needs 60 votes to start debate. After the motion is approved, Sen. Reid will offer Obamacare as a complete substitute to the unrelated House-passed bill. This means that the entire healthcare reform effort will be included as an amendment to a TARP bill that has been collecting dust in the Senate for months.

Step 4: For this strategy to work, the proponents would need to hold together the liberal caucus of 58 Democrats (including Paul Kirk who was named last Thursday to replace Sen. Kennedy), and the two Independent senators (Joe Lieberman of Connecticut and Bernie Sanders of Vermont). These members will have to all hold hands and vote against any filibuster. Once the Senate takes up the bill, only a simple majority of members will be needed for passage. It’s possible one of the endangered moderate Democrats, such as Sen. Blanche Lincoln (Ark.), could vote to stop a filibuster then vote against Obamacare so as not to offend angry constituents.

Once the Senate passes a bill and sends it to the House, all the House would have to do is pass the bill without changes and President Obama will be presented with his health care reform measure. If this plan does not work, the Senate and House leadership may go back to considering using reconciliation to pass the legislation.

Adopting this secret plan will not strike most Americans as a transparent, bipartisan, effective way to change how millions of Americans get their health care.

Brian Darling is director of U.S. Senate Relations at The Heritage Foundation.

http://www.humanevents.com/article.php?id=33740

Wednesday, September 30, 2009

We just threw the remote at the TV we're so angry!!!

Cap & Trade— is it helping the environment or a national energy tax?

Senator Kerry the other day said he didn’t know what “Cap & Trade” was; he’s calling it a “Pollution Reduction Bill”. We call it “Bull”.

http://www.cbsnews.com/blogs/2009/09/15/taking_liberties/entry5314040.shtml

“The Obama administration has privately concluded that a cap and trade law would cost American taxpayers up to $200 billion a year, the equivalent of hiking personal income taxes by about 15 percent.“

“A previously unreleased analysis prepared by the U.S. Department of Treasury says the total in new taxes would be between $100 billion to $200 billion a year. At the upper end of the administration's estimate, the cost per American household would be an extra $1,761 a year.”

“One reason the bill faces an uncertain future is concern about its cost. House Republican Leader John Boehner has estimated the additional tax bill would be at $366 billion a year, or $3,100 a year per family. Democrats have pointed to estimates from MIT's John Reilly, who put the cost at $800 a year per family, and noted that tax credits to low income households could offset part of the bite. The Heritage Foundation says that, by 2035, "the typical family of four will see its direct energy costs rise by over $1,500 per year."

Today, “Senate Democrats on Wednesday introduced a sweeping bill aimed at combating climate change, pushing forward with President Obama's call to tackle global warming even though Congress is waist-deep in debate over health care reform."

“President Obama and House Speaker Nancy Pelosi issued brief statements Wednesday praising the proposal. Obama said he's "deeply committed" to passing such a bill.”

(http://www.foxnews.com/politics/2009/09/30/senate-democrats-push-forward-climate-despite-plate/)

So, the bottom line is they know that it is going to cost all of us and extra $1,761 per year and yet they still want to ram this through? Do you have an extra $1,761 just laying around for the government to take—we don’t.

Call/write/email the White House/Senate/Congress and tell them to vote “NO” on this legislation as it is currently proposed. It’s my money and yours, don’t let the government take anymore of it away!

Senator Kerry the other day said he didn’t know what “Cap & Trade” was; he’s calling it a “Pollution Reduction Bill”. We call it “Bull”.

http://www.cbsnews.com/blogs/2009/09/15/taking_liberties/entry5314040.shtml

“The Obama administration has privately concluded that a cap and trade law would cost American taxpayers up to $200 billion a year, the equivalent of hiking personal income taxes by about 15 percent.“

“A previously unreleased analysis prepared by the U.S. Department of Treasury says the total in new taxes would be between $100 billion to $200 billion a year. At the upper end of the administration's estimate, the cost per American household would be an extra $1,761 a year.”

“One reason the bill faces an uncertain future is concern about its cost. House Republican Leader John Boehner has estimated the additional tax bill would be at $366 billion a year, or $3,100 a year per family. Democrats have pointed to estimates from MIT's John Reilly, who put the cost at $800 a year per family, and noted that tax credits to low income households could offset part of the bite. The Heritage Foundation says that, by 2035, "the typical family of four will see its direct energy costs rise by over $1,500 per year."

Today, “Senate Democrats on Wednesday introduced a sweeping bill aimed at combating climate change, pushing forward with President Obama's call to tackle global warming even though Congress is waist-deep in debate over health care reform."

“President Obama and House Speaker Nancy Pelosi issued brief statements Wednesday praising the proposal. Obama said he's "deeply committed" to passing such a bill.”

(http://www.foxnews.com/politics/2009/09/30/senate-democrats-push-forward-climate-despite-plate/)

So, the bottom line is they know that it is going to cost all of us and extra $1,761 per year and yet they still want to ram this through? Do you have an extra $1,761 just laying around for the government to take—we don’t.

Call/write/email the White House/Senate/Congress and tell them to vote “NO” on this legislation as it is currently proposed. It’s my money and yours, don’t let the government take anymore of it away!

If it’s good enough for the Government, then it’s good enough for us too!

Do we live in a "Do as I say, not as I do" country? Sometimes it appears that way!

Congress—they don’t pay their taxes and they still get appointed to high ranking positions within the government!

News release from Rep. John Boehner:

WASHINGTON, DC – House Republican Leader John Boehner (R-OH) issued the following statement after Rep. John Carter (R-TX) announced his intention to offer a privileged resolution next week to force a vote on removing Rep. Charles Rangel (D-NY) as Chairman of the Ways & Means Committee, pending completion of the Ethics Committee investigation that is now in its second year:

“Working families across America are struggling in today’s economy, and they need to have confidence that the individual in charge of the House’s tax-writing panel is following the laws the committee is charged with crafting and overseeing. It is improper for Rep. Rangel to remain in a position with such vast power and influence while serious questions about his official conduct continue to multiply and go unanswered. Several weeks ago I wrote a letter to Rep. Rangel asking him to step aside while the Ethics Committee conducts its investigation. He has not done so, and his fellow Democrats have voted to protect him every step of the way.

“When Democrats took the majority, Speaker Pelosi promised the most ‘open and ethical’ Congress in history. Given the nature and severity of the charges against Rep. Rangel, I would urge all my colleagues, Democrat and Republican, to do the right thing and support the Carter resolution next week.”

Along this same mind-set:

Congress--they have “opted out” of participating in the health care that they are forcing us to accept and it’s been proposed that if we don’t get health insurance (according to them), we’ll pay a penalty or go to jail!

HYPOCRITES!

Have you heard of the “Rangel Rule”—it is proposed by Rep. John Carter of Texas and states that “if you're caught cheating on your taxes, you would pay what you owe, then write "Rangel Rule" at the top of your return, and you wouldn't be charged any penalty or interest.”

Now, we are not advocating breaking the law, we’re just saying, “fare is fare” and if the politicians aren’t going to participate in the health care that they are forcing on us, then we should be able to express our dissatisfaction in a similar fashion (without penalties or jail time) as the “Rangel Rule” would allow. We feel that we should be able to write something similar across the top of our government-issued insurance forms when we declare that we do not want what they are providing!

What do you think? What could we write across the top of our insurance forms? How about “Congressional Coverage” or “Representative Repudiation”?

We’d love to know your suggestions and urge you to share them with your elected Representatives as well.

Summer is gone, but the passion that was alive and well during the August town halls has not diminished. Please continue to write/call/email the White House, Senate, and Congress and let them know how you feel—it does matter and you are making a difference!

"The essence of Government is power; and power, lodged as it must be in human hands, will ever be liable to abuse. Do you feel as though the power we gave our politicians has been abused?" (James Madison-from a speech in the Virginia Constitutional Convention, 12/2/1829)

God Bless America and thanks for your consideration.

Congress—they don’t pay their taxes and they still get appointed to high ranking positions within the government!

News release from Rep. John Boehner:

WASHINGTON, DC – House Republican Leader John Boehner (R-OH) issued the following statement after Rep. John Carter (R-TX) announced his intention to offer a privileged resolution next week to force a vote on removing Rep. Charles Rangel (D-NY) as Chairman of the Ways & Means Committee, pending completion of the Ethics Committee investigation that is now in its second year:

“Working families across America are struggling in today’s economy, and they need to have confidence that the individual in charge of the House’s tax-writing panel is following the laws the committee is charged with crafting and overseeing. It is improper for Rep. Rangel to remain in a position with such vast power and influence while serious questions about his official conduct continue to multiply and go unanswered. Several weeks ago I wrote a letter to Rep. Rangel asking him to step aside while the Ethics Committee conducts its investigation. He has not done so, and his fellow Democrats have voted to protect him every step of the way.

“When Democrats took the majority, Speaker Pelosi promised the most ‘open and ethical’ Congress in history. Given the nature and severity of the charges against Rep. Rangel, I would urge all my colleagues, Democrat and Republican, to do the right thing and support the Carter resolution next week.”

Along this same mind-set:

Congress--they have “opted out” of participating in the health care that they are forcing us to accept and it’s been proposed that if we don’t get health insurance (according to them), we’ll pay a penalty or go to jail!

HYPOCRITES!

Have you heard of the “Rangel Rule”—it is proposed by Rep. John Carter of Texas and states that “if you're caught cheating on your taxes, you would pay what you owe, then write "Rangel Rule" at the top of your return, and you wouldn't be charged any penalty or interest.”

Now, we are not advocating breaking the law, we’re just saying, “fare is fare” and if the politicians aren’t going to participate in the health care that they are forcing on us, then we should be able to express our dissatisfaction in a similar fashion (without penalties or jail time) as the “Rangel Rule” would allow. We feel that we should be able to write something similar across the top of our government-issued insurance forms when we declare that we do not want what they are providing!

What do you think? What could we write across the top of our insurance forms? How about “Congressional Coverage” or “Representative Repudiation”?

We’d love to know your suggestions and urge you to share them with your elected Representatives as well.

Summer is gone, but the passion that was alive and well during the August town halls has not diminished. Please continue to write/call/email the White House, Senate, and Congress and let them know how you feel—it does matter and you are making a difference!

"The essence of Government is power; and power, lodged as it must be in human hands, will ever be liable to abuse. Do you feel as though the power we gave our politicians has been abused?" (James Madison-from a speech in the Virginia Constitutional Convention, 12/2/1829)

God Bless America and thanks for your consideration.

Sunday, September 27, 2009

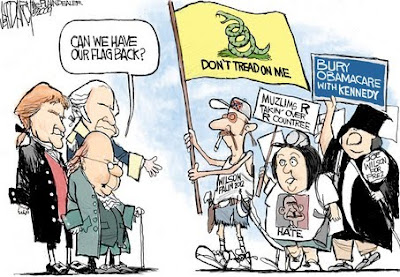

No! I don't think so....Because did it ever really belong to you in the first place?

The picture above kinda makes me angry. What is Jeff Darcy trying to say in this picture? Even Old Glory belongs to the people first ! Correct me if I am wrong. I could spend hours picking apart this pic, but I think you can judge for your self of what picture the liberal media is painting of the Tea Party Patriots. It does not insult me but it does make me want to fight harder, because no matter how much they ignore the Tea Parties, someone is hearing us loud and clear!

Tea Party Patriots - Take Ohio Back for Ohio!

Fellow Tea Party Patriots

As we continue the fight to save our country, we must not lose sight of the problems plaguing our state of Ohio. AS we all know, and as numerous reports, studies, and polls show, due to archaic tax laws and business killing policies - Ohio is dying a slow death.

As witnessed with our blown state budget, which is now akin to a Grand Canyon size gap, we must also concentrate our efforts here at home.

There is currently a package of 10 "job creating, tax-lowering, student & economic development -friendly" proposals in the Ohio House Economic Development Committee that are not only receiving no attention -- but they are being ignored. We cannot allow this to happen!

The Tea Party Patriots and all our fellow conservative groups in OH must save our state from hemorrhaging more jobs and further plunging into an economic abyss - we must Take Ohio Back for Ohio!

Our first step is to get educated on the "Future of Ohio" package languishing in the OH House. We have contacted the office of State Rep. Nan Baker (R-Westlake), the ranking minority leader on the OH House Economic Development Committee, & State Rep. Todd Snitchler (R-Uniontown) for more information on these proposals....

Now -- to get this going, with the same energy we've already shown in our battle against a country-killing Cap & Trade bill and government run health care, we are asking phone calls, emails and letters be sent to Gov. Strickland, OH House Speaker Rep. Armond Budish, Democrat members on the OH House Economic Development Committee & your local OH State Rep's and urge them to put their money where their mouth is when it comes to saving jobs and saving our state!

Governor Strickland

Governor's Office

Riffe Center, 30th Floor

77 South High Street

Columbus, OH 43215-6108

Phone: (614) 466-3555

Fax: (614) 466-9354

Email: Click Here

Speaker of the House

Armond D. Budish (D-Beachwood)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5441

Fax: (614) 719-0008

Email: district08@ohr.state.oh.us

Economic Development Committee

Chairwoman

State Representative Sandra Williams (D-Cleveland)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-1414

Fax: (614) 719-0011

Email: district11@ohr.state.oh.us

Vice-Chair

Representative Denise Driehaus (D-31st District)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5786

Fax: (614) 719-3585

Email: district31@ohr.state.oh.us

State Representative Michael DeBose (D-Cleveland)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-1408

Fax: (614) 719-3912

Email: district12@ohr.state.oh.us

State Representative Timothy J. DeGeeter (D-Parma)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 466-3485

Fax: (614) 719-3911

Email: district15@ohr.state.oh.us

State Representative Jay Goyal (D-Mansfield)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5802

Fax: (614) 719-3973

Email: district73@ohr.state.oh.us

State Representative Tracy Maxwell Heard (D-26)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-8010

Fax: (614) 719-3580

Email: district26@ohr.state.oh.us

State Representative Matt Lundy (D-57th District)

Address: 77 S. High St

12th Floor

Columbus, OH 43215-6111

Phone: (614) 644-5076

Fax: (614) 719-3957

Email: district57@ohr.state.oh.us

State Representative Dennis Murray (D-Sandusky)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 644-6011

Fax: (614) 719-6980

Email: district80@ohr.state.oh.us

State Representative Debbie Phillips (D-Athens)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 466-2158

Fax: (614) 719-6992

Email: district92@ohr.state.oh.us

State Representative Raymond Pryor (D-Chillicothe)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 644-7928

Fax: (614) 719-6985

Email: district85@ohr.state.oh.us

State Representative Peter S. Ujvagi (D-Toledo)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 644-6017

Fax: (614) 719-6947

Email: district47@ohr.state.oh.us

Click here for all Economic Development Committee members. Click here to find your OH House Representative.

As we continue the fight to save our country, we must not lose sight of the problems plaguing our state of Ohio. AS we all know, and as numerous reports, studies, and polls show, due to archaic tax laws and business killing policies - Ohio is dying a slow death.

As witnessed with our blown state budget, which is now akin to a Grand Canyon size gap, we must also concentrate our efforts here at home.

It is time for us to "Take Ohio Back for Ohio"

There is currently a package of 10 "job creating, tax-lowering, student & economic development -friendly" proposals in the Ohio House Economic Development Committee that are not only receiving no attention -- but they are being ignored. We cannot allow this to happen!

The Tea Party Patriots and all our fellow conservative groups in OH must save our state from hemorrhaging more jobs and further plunging into an economic abyss - we must Take Ohio Back for Ohio!

Our first step is to get educated on the "Future of Ohio" package languishing in the OH House. We have contacted the office of State Rep. Nan Baker (R-Westlake), the ranking minority leader on the OH House Economic Development Committee, & State Rep. Todd Snitchler (R-Uniontown) for more information on these proposals....

"Future of Ohio"

- Employer tax credit to hire unemployed Ohioans: H.B. 277 (Todd Snitchler) would authorize a nonrefundable tax credit for hiring and employing previously unemployed individuals. Ohio businesses that hire previously unemployed individuals will receive a $2,400 tax credit for each such employee that they employ. Each credit will be claimable for up to two years so long as the employee was unemployed for four consecutive weeks immediately preceding their hiring date; the employee is lawfully employable in the United States; and the employee is continuously employed by the employer claiming the credit for a period of two years.

- Small business capital loans: This bill would authorize the creation of a low to zero interest loan program for small businesses through the local business linked deposit program.

- Tax credits for Ohio graduates: H.B. 144 (Cheryl Grossman) would grant an income tax credit eliminating tax liability for five years for individuals who obtain a baccalaureate degree and who reside in Ohio. Eliminating the state income tax liability for graduates will allow them to use the extra money to help pay back their student loans and other debts incurred during college, as well as attract college students from other states.

- Tax credits for specialized crafts: This bill would apply the income tax provisions of H.B. 144 to any person in a trade who has reached the journeyman status or its equivalent.

- Estate tax relief: This bill would reduce the estate tax, authorize townships and municipal corporations to exempt from the estate tax by initiative any estate property located in the township or municipal corporation, and distribute all estate tax revenue originating in a township or municipal corporation that does not exempt property from the tax to the township or municipal corporation of origin.

- Small business regulatory reforms – S.B. Companion 3 (Keith Faber): S.B. 3, a package of small business reforms, is currently under consideration in the House State Government Committee and has been under debate since mid-March. In order to expedite passage of S.B. 3’s key provisions, we drafted companion legislation covering three key proposals to help businesses cut through bureaucratic red tape and provide accountability in crafting agency regulations.

- Small business resource portal: This bill would direct ODOD to create an online small business resource center (expanding upon the existing Ohio Business Gateway) on its internet website, to serve as a clearinghouse of information relevant to Ohio businesses.

- Private Sector compensatory time – S.B. 17 Companion (Kevin Coughlin): This proposal would provide more flexibility, allowing an employer to instead provide compensatory time, or paid time off of work. The intent of this legislation is to enable employers to provide a more family friendly work environment by providing flexibility for their employees. S.B. 17

- Tracking job placement success: This bill would require the Ohio Department of Job and Family Services to submit annually to the leaders of the General Assembly a copy of the report submitted to the United States Department of Labor pursuant to the federal Workforce Investment Act and to make a copy of the report available on the department's website.

- Analyzing company exodus: This bill would require the Ohio Department of Development to produce a report of companies that have relocated out of Ohio, develop a standard questionnaire to elicit the reasons why those companies have chosen to leave Ohio, and share its findings with the legislature.

Now -- to get this going, with the same energy we've already shown in our battle against a country-killing Cap & Trade bill and government run health care, we are asking phone calls, emails and letters be sent to Gov. Strickland, OH House Speaker Rep. Armond Budish, Democrat members on the OH House Economic Development Committee & your local OH State Rep's and urge them to put their money where their mouth is when it comes to saving jobs and saving our state!

Governor Strickland

Governor's Office

Riffe Center, 30th Floor

77 South High Street

Columbus, OH 43215-6108

Phone: (614) 466-3555

Fax: (614) 466-9354

Email: Click Here

Speaker of the House

Armond D. Budish (D-Beachwood)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5441

Fax: (614) 719-0008

Email: district08@ohr.state.oh.us

Economic Development Committee

Chairwoman

State Representative Sandra Williams (D-Cleveland)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-1414

Fax: (614) 719-0011

Email: district11@ohr.state.oh.us

Vice-Chair

Representative Denise Driehaus (D-31st District)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5786

Fax: (614) 719-3585

Email: district31@ohr.state.oh.us

State Representative Michael DeBose (D-Cleveland)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 466-1408

Fax: (614) 719-3912

Email: district12@ohr.state.oh.us

State Representative Timothy J. DeGeeter (D-Parma)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 466-3485

Fax: (614) 719-3911

Email: district15@ohr.state.oh.us

State Representative Jay Goyal (D-Mansfield)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-5802

Fax: (614) 719-3973

Email: district73@ohr.state.oh.us

State Representative Tracy Maxwell Heard (D-26)

Address: 77 S. High St

14th Floor

Columbus, OH 43215-6111

Phone: (614) 466-8010

Fax: (614) 719-3580

Email: district26@ohr.state.oh.us

State Representative Matt Lundy (D-57th District)

Address: 77 S. High St

12th Floor

Columbus, OH 43215-6111

Phone: (614) 644-5076

Fax: (614) 719-3957

Email: district57@ohr.state.oh.us

State Representative Dennis Murray (D-Sandusky)

Address: 77 S. High St

13th Floor

Columbus, OH 43215-6111

Phone: (614) 644-6011

Fax: (614) 719-6980

Email: district80@ohr.state.oh.us

State Representative Debbie Phillips (D-Athens)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 466-2158

Fax: (614) 719-6992

Email: district92@ohr.state.oh.us

State Representative Raymond Pryor (D-Chillicothe)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 644-7928

Fax: (614) 719-6985

Email: district85@ohr.state.oh.us

State Representative Peter S. Ujvagi (D-Toledo)

Address: 77 S. High St

11th Floor

Columbus, OH 43215-6111

Phone: (614) 644-6017

Fax: (614) 719-6947

Email: district47@ohr.state.oh.us

Click here for all Economic Development Committee members. Click here to find your OH House Representative.

Labels:

Action Alert,

General,

Ohio,

Take Back Ohio for Ohio

Lawmakers work to reenergize Ohio

We want to thank Sara from State Rep Nan Baker's office for forwarding us the following requested press release...

For Immediate Release

September 21, 2009

Media Contact: Megan Piwowar

(614) 466-0863

Lawmakers work to reenergize Ohio

Cleveland—State Representative Nan Baker (R-Westlake) today unveiled proposals by Ohio House Republicans to spur economic development. Baker and other members of the House Republican Caucus, including Minority Leader William G. Batchelder (R-Medina) and Representatives Ron Amstutz (R-Wooster), Todd Snitchler (R-Uniontown), Dave Hall (R-Killbuck), and Terry Boose (R-Norwalk), revealed extensive plans to bring about job creation and industry growth.

“During this economic crisis, with everything at stake, Ohio cannot afford another second of inaction on the part of House leadership,” Baker said. “As the ranking minority member of the House Economic Development Committee, I have become increasingly frustrated by the Democrat leadership’s unwillingness or inability to lead. Therefore, House Republicans worked tirelessly over summer recess to create a collection of economic proposals that could potentially turn the economy around.”

The press conference, in conjunction with four other conferences across the state, was conducted to address the failure of the Democrat-controlled Economic Development Committee to conduct regular, productive hearings on the economic condition of Ohio.

“The Republican caucus is focused on what Ohioans care about the most, jobs and economic development,” Batchelder said. “While Democrats have not given priority to the creation of jobs, we have been working on solutions for Ohio’s economy.”

Frustrated with inaction on the part of Governor Strickland and the Economic Development Committee, Republican members engaged in discussions with the local business community for ideas to revamp Ohio's economy. Based on their findings from market research and conversations with constituents, the House Republicans created a package of proposals that were announced at the press conferences and will be introduced in the coming weeks.

“So far, the Democrats have not shown that they are willing to make any important decisions regarding economic development within our state,” Hall said. “How many more businesses and young people need to flee the state before the Democrats decide they need to act?”

Among these ten bills are proposals to offer employer tax credits to hire unemployed Ohioans and to grant income tax credits for college graduates who remain in Ohio. Altogether, these bills are designed to provide resources to small businesses, offer incentives for businesses and young people to remain in Ohio, and track Ohio's progress in rebuilding its economy.

“In presenting a package of economic proposals, our goal is to spark an honest, constructive debate about the best course of action for Ohio’s future,” Amstutz said. “House Republicans have a specific plan in place to bring about economic recovery, but since the onset of this General Assembly our voices have been silenced, regardless of how practical our ideas were.”

“This recession is affecting all Ohioans, both Republican and Democrats,” Snitchler said. “We need to all work together to provide a solid foundation for Ohio’s economic future. We encourage lawmakers at all levels of government to consider our proposals and use them as they wish—changing the course of Ohio is what is important, not receiving credit or praise.”

The House Economic Development Committee has only met four times since the commencement of the 128th General Assembly and has yet to pass a single bill. The only item to pass out of committee was an ineffectual House Resolution that created the Compact With Ohio Cities Task Force, which focuses on local municipalities rather than the economic health of the entire state.

“Ohioans have entrusted us to make difficult decisions during difficult times, and we have an obligation to uphold our commitment,” Boose said. “This is not the time to coast. This is not the time to sit back with our fingers crossed. Ohio needs action, and if the Democrats won’t step up to the plate then I will.”

-30-

Thursday, September 24, 2009

OH Supreme Court upholds Tax on Groceries

Since we are not already burdened with too many taxes in OH our robed Republican rubes riding the big bench in Columbus ruled it is OK for gross receipts of grocery stores to be taxed...

And one would presume a State Supreme Court Justice would be smart enough to realize that if the grocery stores are taxed on the total amount of food items they sell then this cost will be passed onto consumers on the un-taxed grocery items they purchase - thus creating a sales tax on groceries.

I love how they say you must pay for the "privilege" of doing business in OH.

The Ohio Supreme Court ruled the state can continue to collect a business tax when it’s applied to grocery store food sales, avoiding what could have been an $188 million annual hole in the state budget.

In a 6-1 decision, the court upheld the collection of the Commercial Activities Tax on food sold by grocery stores and others for offsite consumption. The Ohio Grocers Association had argued that applying the tax to food sales violated the state Constitution, which prohibits sales taxes on the sale of food that’s taken off store premises to eat.

The tax amounts to 26 cents per $100 in sales over $1 million, or a flat rate of $150 for the first $1 million in sales, as long as sales are above $150,000. State tax officials estimate the portion of the tax collected on food receipts would amount to about $188 million a year.

Lawmakers have called the tax as one levied on the privilege of doing business in Ohio, but grocers argued the payment amounted to a sales tax.

The court rejected that argument, noting that state laws are given a strong presumption of constitutionality and that the court was required to uphold the tax if it may “plausibly be determined as permissible.” (Canton Repository)

And one would presume a State Supreme Court Justice would be smart enough to realize that if the grocery stores are taxed on the total amount of food items they sell then this cost will be passed onto consumers on the un-taxed grocery items they purchase - thus creating a sales tax on groceries.

I love how they say you must pay for the "privilege" of doing business in OH.

Subscribe to:

Posts (Atom)